To Our Clients and Friends,

The following information is provided to assist you with 2022 year end reporting and 2023 planning. We’ve included a PDF download if you prefer.

Download our 2022 Tax Year End Letter

1099 Reporting:

As in prior years, you are required to file 1099’s for payments made in the course of your trade or business for:

- Dividends of $10 or more.

- Compensation of $600 or more for services to all independent contractors (except corporations)

- $600 or more of fees paid to attorneys even if they are a corporation.

- Interest of $10 or more.

- Rents of $600 or more.

- Royalties of $10 or more.

- Fees, commissions, prizes, awards to non-corporate payees of $600 or more.

- All distributions from company pension and profit sharing plans.

The forms to be used are Form 1099-DIV (dividends), 1099-INT (interest), 1099-MISC (other

payments), 1099-R (distributions from retirement plans), and 1099-NEC (nonemployee compensation).

Oregon disallows deductions for all expenses requiring a 1099, if no 1099 is issued.

Retirement & Health Savings Account Plans:

Maximum 401(k) Elective Deferral

Additional 401(k) Elective Deferral for 50 years old or over

Defined Contribution Plan Limit (Plus over 50 deferral)

Maximum Eligible Compensation for Defined Contribution Plan

SIMPLE Retirement Plan Salary Deferral

Additional SIMPLE Deferral for 50 years old or over

IRA contribution limit

Additional IRA contribution for 50 years old or over

Health Savings Account – individual

Health Savings Account – family

Additional Health Savings Account for 55 years old or over

Miscellaneous Information:

Standard Mileage Rate Jan. 1 thru Dec. 31

Charitable Mileage Rate Jan. 1 thru Dec. 31

Medical Purposes Rate Jan. 1 thru Dec. 31

Social Security:

Maximum earned income allowed before reduction in Social Security Benefits

62 until Full retirement age

Full retirement age attained during 2021

Full retirement age varies between 65 and 67 depending on birthdate

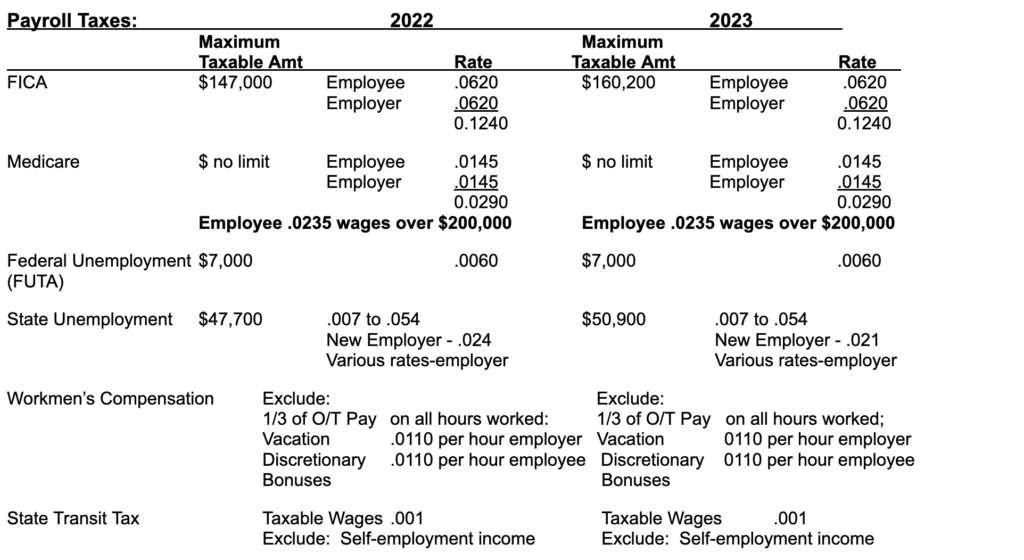

Payroll:

2022

$20,500

$6,500

$61,000

$305,000

$14,000

$3,000

$6,000

$1,000

$3,650

$7,300

$1,000

2022

62.5¢ (.560)

14.0¢ (.140)

18.0¢ (.160)

2022

—–

$ 19,560

———

unlimited

2023

$22,500

$7,500

$66,000

$330,000

$15,500

$3,500

$6,500

$1,000

$3,850

$7,750

$1,000

2023

n/a

14.0¢ (.140)

18.0¢ (.180)

2023

—–

$21,240

$56,520

unlimited

Minimum Wage:

2022 Oregon Minimum Wage – $12.50 starting 7/1/22

2023 Oregon Minimum Wage – $12.50 starting 7/1/23

Additional W-2 Items:

Personal use of corporate owned autos, if not reimbursed to the corporation, must be included as part of total compensation on W-2 Forms. Additionally, the amounts must be listed in Box 14 on the W-2 Forms. This amount is subject to all payroll taxes. If you need help in determining the personal use amount, please call our office with the following information:

- Make, Model and Year

- Date acquired and original purchase price

- Total miles and personal miles

State wide transit tax is a tax for all Oregon working residents regardless of where work is performed and all non-resident persons who perform work inside Oregon. This tax is one-tenth of one percent, or .001, of the taxable wages and is not subject to exemptions, so employees who do not pay income tax due to high exemptions will still be taxed. Self-employment income is not subject to this tax. The total tax amount deducted from wages will be reported in Box 14 on the W-2 Forms.

The cost of health and accident insurance premiums paid on behalf of greater than 2% S Corporation Shareholders is deductible by the S Corporation and reportable as additional compensation to the Shareholder. The additional compensation is included in Box 1 and Box 16 (Wages) of the Form W-2. Also include on fourth-quarter 941, Box 1 and Column B, Box 1 of the OQ. If these payments are made under a “plan” for the S Corporation employees and their dependents, the amount would only be subject to income tax withholding and would not be included in Boxes 3 or 5 of Form W-2 for Social Security or Medicare; nor would it be subject to the FUTA tax.

For employers with over 50 full time employees, the health insurance premiums paid by the employer and employee must be included in Box 12 of the W-2 form with a code of DD. Each employer must file forms 1094-C and 1095-C with the IRS and supply each full time employee with form 1095-C with their form W-2. See IRS notice HCTT-2015-62 for more details.

Employers with 10 or more employees must provide at least 40 hours of paid sick time in 2022, accrued at a rate of .03333 per hour worked. In Portland employers are required if they have 6 employees.

Please be aware that Paid Leave Oregon goes into effect January 1st, 2023. For more information on this you can visit their website at: https://paidleave.oregon.gov

Please feel free to contact our office if you have any questions.

Regards,

WICKS EMMETT LLP

Certified Public Accountants